The contentious alteration to Ethereum’s blockchain, EIP 1559, is coming into full effect on the mainnet by the end of July. A significant milestone in the overarching Eth 2.0 upgrade aims to burn the gas fees initially being sent straight to the miners. The upgrade also helps predict the transactional cost to make it fair for all Ethereum users. While the current market condition may be favorable to anyone transacting on Ethereum (as the gas fees are predictably lower), the overall problem of dealing with high gas fees has left many enthusiasts with no choice but to adopt alternative solutions like Layer 2 scaling or switching to networks like Binance Smart Chain and Solana.

Why all the fuss about Ethereum gas?

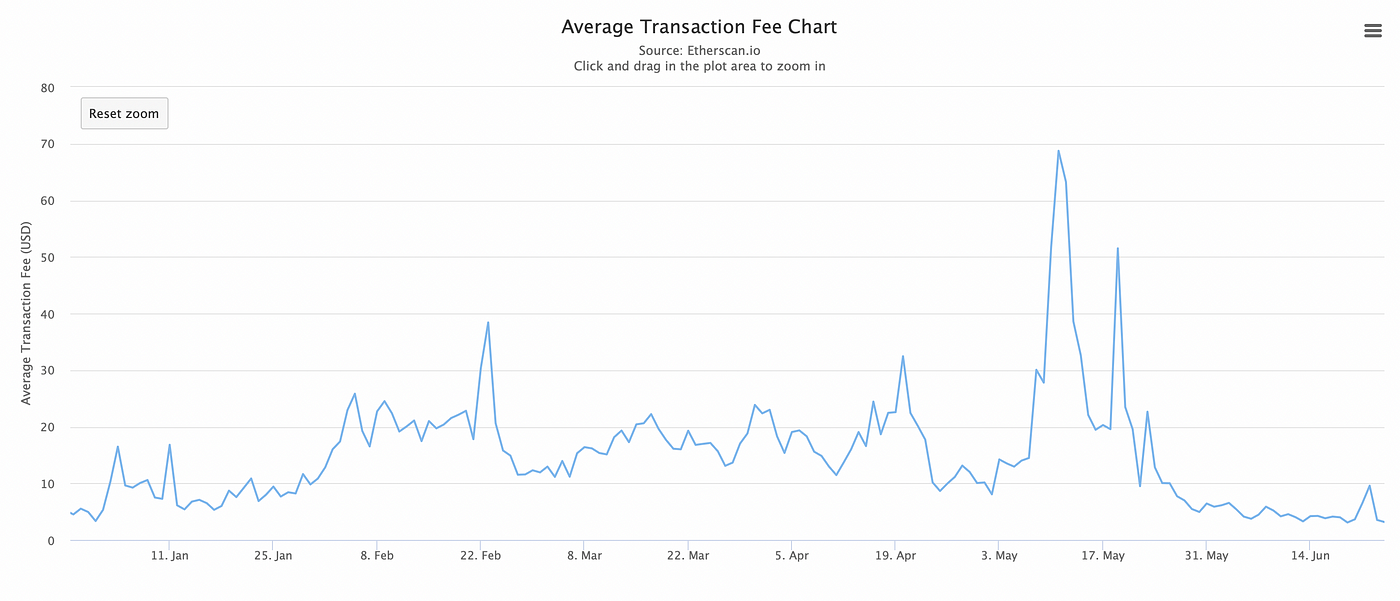

A couple of weeks ago, the transaction cost for a swap on Uniswap was as high as $105. While it may have fallen now for obvious reasons, the high-congestion high fees inherent problem remains intact — as is visible in the chart.

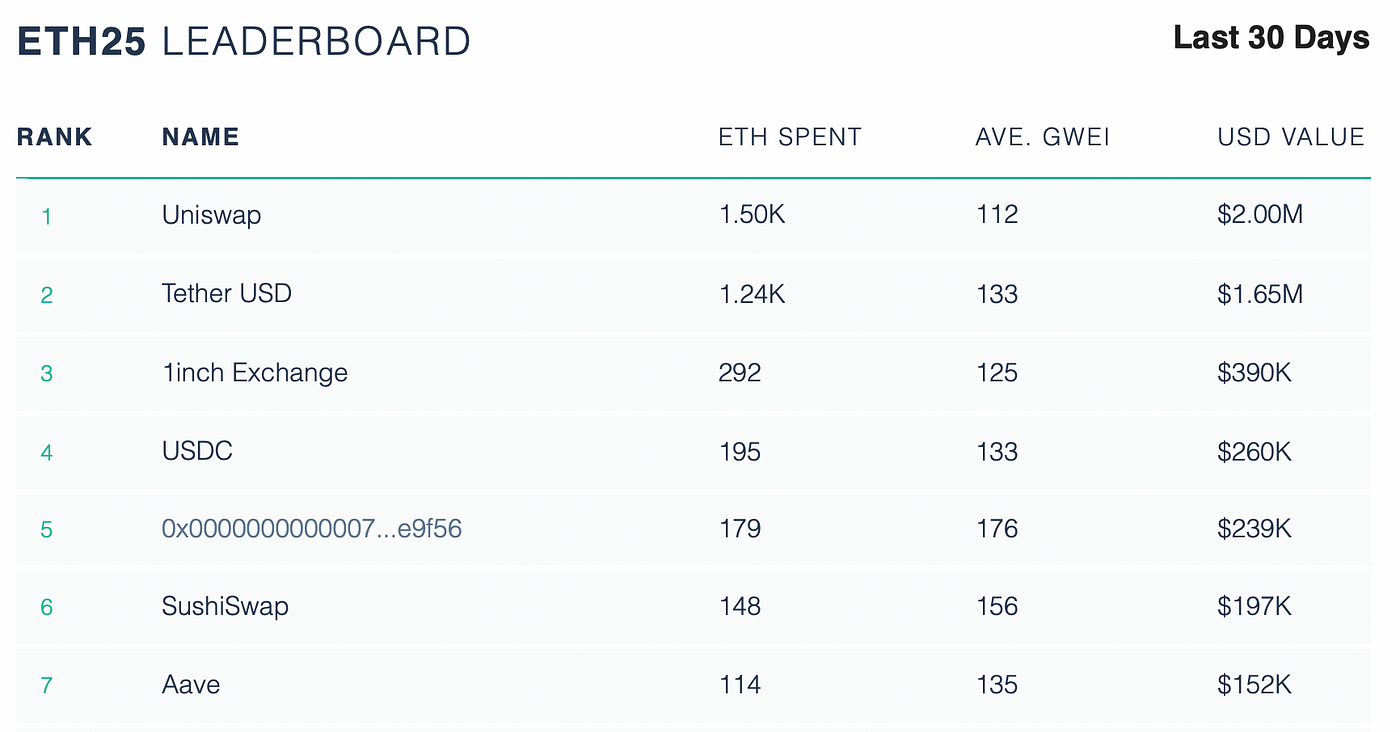

Because of the development of numerous complex DeFi applications along with several users trying to create NFT, the gas fees for the Ethereum blockchain are rising at an astronomical pace. This renders small participants almost handicapped as they are unable to afford the transactions. Some DeFi applications that consume a staggering amount of fees are Uniswap, 1inch, and SushiSwap. Notable factors include the stable coin Tether (which is a crucial component in DeFi), an overall increasing popularity of NFTs, and yield farming. Both cause a considerable rise in fees. As the leaderboard shows us, Uniswap and even the stablecoin Tether have huge transaction costs.

How much gas do I need to pay?

The transaction cost on Ethereum is determined by two factors: gas price (measured in GWEI) and gas limit. The gas limit doesn’t change with network congestion, only gas price(GWEI) does — which goes higher as network congestion increases.

Note, however, that gas price is the amount of ether (or GWEI) that you are willing pay to for each unit of gas.

Each transaction or application on the Ethereum network requires a different amount of gas limit. If you were to set the gas limit for a simple ETH transfer at 20,000, then all of that will be consumed but because it is less than the 21,000 units required, your transaction won’t complete. This will lead to the reversion of any changes done on the EVM. Note, however, that by then the miner would have already performed 20,000 units worth of computational work — which means that the gas limit would have been consumed.

On the Eth network, smart contracts are responsible for performing transactions; and they are getting increasingly getting complex due to the emergence of decentralized applications. This leads to an increase in the number and type of operations a contract has to perform, which means individual transactions take up more space in a specified block size. Thus, if the demand for these transactions increases then the gas price increases as all users are trying to outbid each other.

A simple way to calculate the gas price is to multiply the gas price by the amount of gas required for the transaction.

Gas consumption are also subject to the complexity of a smart contract. An increasing number of DeFi applications has necessitated creating complex contracts that require a significant amount of consumption.

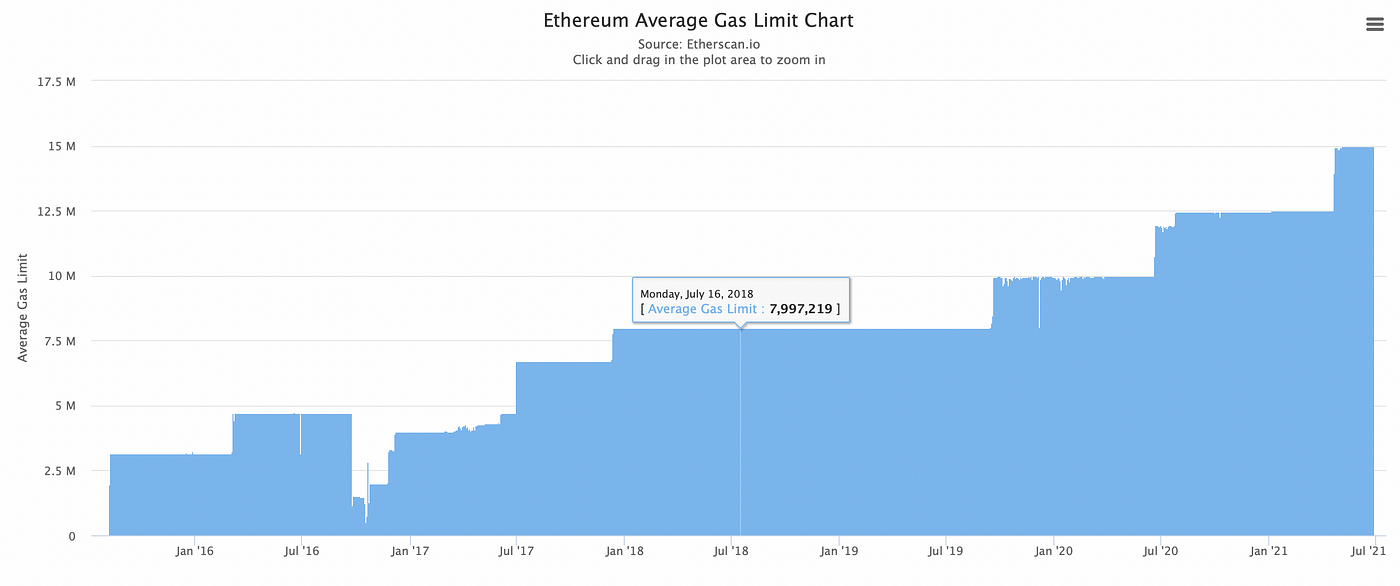

Is there an upper limit to gas “limit”?

Yes, the current block gas limit is 15 million — which means that each block can process transactions with a combined expenditure of 15 million gas.

A transaction fails to complete if the gas limit specified is below the gas required to complete it.

Circumventing the high gas fees on Ethereum

There are two notable ways.

- Users can migrate to other projects like BSC, Polygon, Fantom, Solana, and/or

- Build on Ethereum’s Layer 2 scaling solutions.

Some projects like SushiSwap, AAVE, and Curve have employed the latter solution on Polygon — which charges extremely low gas fees. In fact, the TVL in Polygon stands at $12.8B. The stablecoin USDT has already launched on TRON (an alternative blockchain platform) exceeding that of Ethereum. These are popular mid-term options, offering respite to users while the transition to Eth 2.0 is in progress.

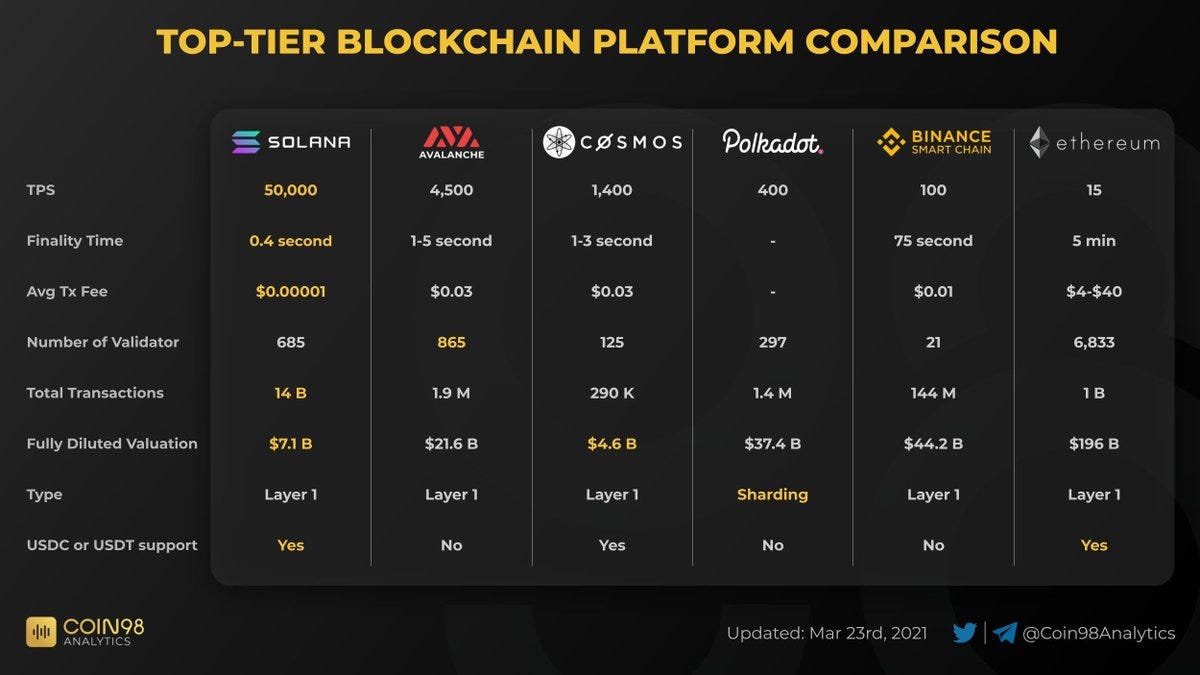

Several users have also switched to other networks like Binance Smart Chain (BSC) and Solana, which charge a comparatively lower fee. For the former, we know that PancakeSwap is why BSC is seeing a noticeable demand from users. This is visible in the chart below comparing different blockchain platforms and how they are faring against each other.

Another favored-but-scrutinised alternative is a gas token. As the name suggests, it tokenizes gas so users can store it when it is cheap (low congestion in the network) and expend it when it is expensive (high congestion in the network). An example of this is the Chi gastoken introduced by 1inch. A notable challenge to tokenizing gas is that if a huge number of gas tokens are spent all at once, they will congest the network.

While these might be considerable alternatives, a significant step forward for Ethereum users is definitely the EIP 1559, which has been in the making since 2019 when it was first suggested.

What is the EIP 1559?

It is a major milestone in the journey from Ethereum 1.0 to 2.0. It proposes a fundamental change to how miners are rewarded for the transactions that they validate. Currently, the miners are awarded the gas fees basis on a first-price auction. In this, transactors submit gas prices they are willing to pay for a transaction and compete with each other for space on the Ethereum block.

EIP 1559 proposes a split-fee model which includes Base Fees and Inclusion Fees.

- The base fee is the required amount to be paid for a transaction to be validated and is set according to the network congestion.

- The inclusion fee is an optional tip paid by users to miners if they want their transactions to be validated quickly.

- Ethereum attempts to keep 50% of blocks full thereby leaving a considerable space empty. Thus, only a small tip would suffice to jump the queue. For example, if a block is 100% or 50% full, the base fee increases by 12.5%, and if it is 0% full, the base fee will decrease by 12.5%.

The entire base fee for each transaction is set to be burnt. This will make ETH a deflationary asset, but that will only happen if the amount of fee burnt is greater than the new ETH created as block rewards.

This implementation will ease the network off congestion and remove unnecessary delays. The major challenge miners face is the reduction in reward, which has been their bone of contention with the implementation.

EIP 1559 and its Impact

The motive behind the upgrade is to have a “counterbalance” to the increasing supply of Ether. What people have misconstrued is that the gas fees are going to see a sharp decline. In fact, the objective is to reduce the high volatility of the gas fees by algorithmically adjusting the fees at a factor of 1.125x per block. Moreover, the burning of base fees ensures that no one can cause a high congestion in the network.

While most miners are continuously debating the overall reduced fees (and it is alleged that some even want to attack the network) the biggest Ethereum mining pool, Sparkpool has come out in favor of the change.

Closing Thoughts

EIP 1559 went live on Ropsten last week on June 24. It is poised to successfully fulfill its objective of reducing the volatility of the gas fees and helping low-fee-paying users save them from endless wait times for their transactions to be validated. Burning the base fee coins ensures that there is an adequate supply of Eth tokens in circulation.

Overall, the implementation helps in re-positioning Ethereum as the base network for all DeFi applications.

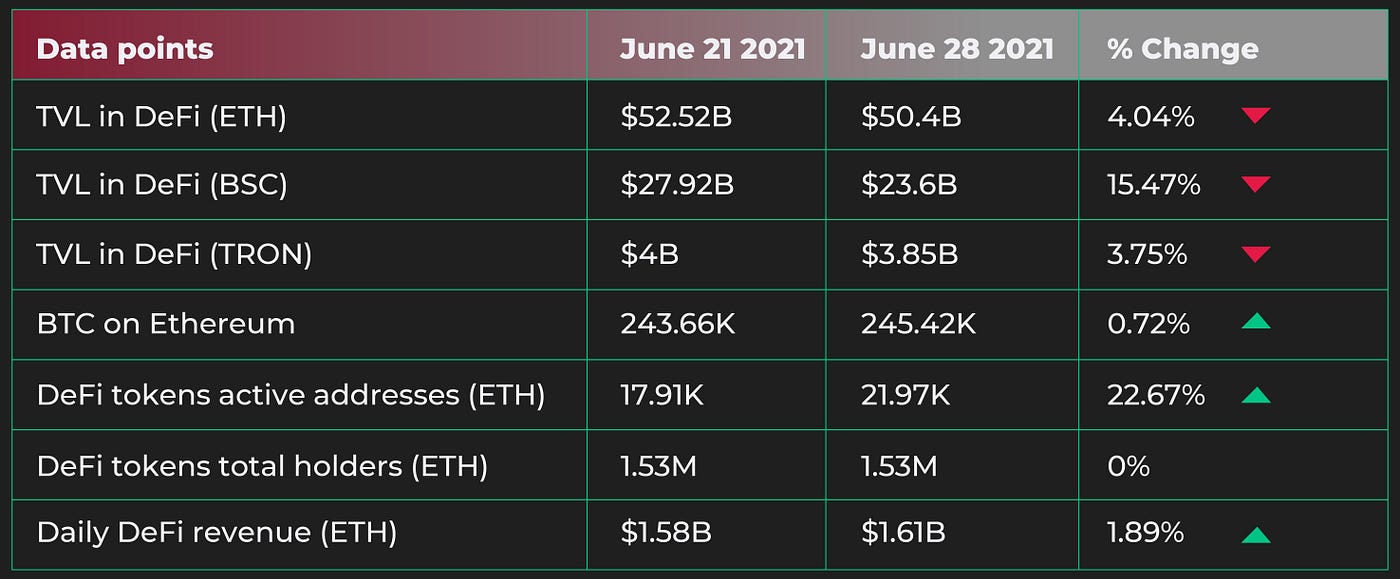

DeFi stats:

Top DeFi updates

Malt Protocol to compensate users after coin launch fail

Malt Protocol created a “capital-efficient” token that can be pegged to any value. Inspired by previous algorithmic stablecoins, the underlying protocol got a TVL of $50M in 24 hours. As its price pushed beyond $1, its “Stabilizer” started minting and selling it for as much as 500,000% APR. As LPs (liquidity providers) increased, the underlying Polygon network got congested leading to some failed transactions. Currently, there are $17M funds locked, and the team has offered to compensate.

Polywhale abandoned by devs

Polywhale Finance, the first yield farming protocol on Polygon, has abandoned the project after withdrawing $1M in tokens due to bad tokenomics and increasing competition. The community members have alleged the entire project as a scam and said that this was a “soft” rug pull.

Detect smart contract risks with Coinbase’s “Solidify”

Solidify is a smart-contract security tool developed by Coinbase that helps “automate, standardize, and scale” the process of smart contracts. It aims to solve the problem of manual security error identification by using a huger signature database and a “pattern matching engine to reliably detect contract features and their risks.” Coinbase admits that complex assets like “AMMs and other DeFi applications” require considerable manual analysis.

Yearn Finance consolidates ETH & WETH in One Wallet

Yearn Finance has just upgraded its ETH Vault by introducing additional features like Vyper’s latest version, enhanced security, and MEV protection, among others. Now, users will find both their ETH and WETH in one “consolidated” vault. They are phase-wise rolling out strategies, including lending on AAVE and Alpha Homora, and also single-side deposit to Curve StETH pool and Curve SeETH pool.

DeFi Dose: Gas

Gas is the “fee” that is required for a transaction to take place or a smart contract to execute on the Ethereum blockchain. So, whenever you create an NFT or withdraw/deposit to a wallet (i.e., program its smart contract on the blockchain), you pay a fee.

This is usually paid in Ether and measured in Gwei. It is paid as compensation for the computational expenses incurred on miners when they validate transactions/smart contracts on the blockchain.

About ClayStack:

ClayStack is a decentralized liquid staking protocol that enables you to earn staking rewards while keeping your assets liquid. Without any lockups.

Get the latest updates!

Learn more about ClayStack, interact with our team, engage in community discussions, and share your valuable feedback.

- Telegram: https://t.me/claystack

- Twitter: https://twitter.com/ClayStack_HQ

- Website: https://claystack.com/

- Announcements: https://t.me/claystackchannel

- Alpha program: https://claystack.com/contact/alpha_tester