Layer 1 blockchains have been competing for our attention for the past few weeks. Particularly due to the advent of various incentive programs designed to increase both user adoption and defi (products) on the networks. The latest updates come from Fantom, Avalanche, and Celo launching their incentivization programs collectively worth over almost a billion dollars.

In an ideal world, scaling of user acquisition happens post achieving a successful product-market fit. In the case of these networks, until a few months ago, defi (and active wallets) were like an isolated forest primarily driven by the core community members responsible for building the products and utilizing them — while closely collaborating with the core team. However, in this process, the network (and the products) achieved PMF. Hence, the next step — adoption.

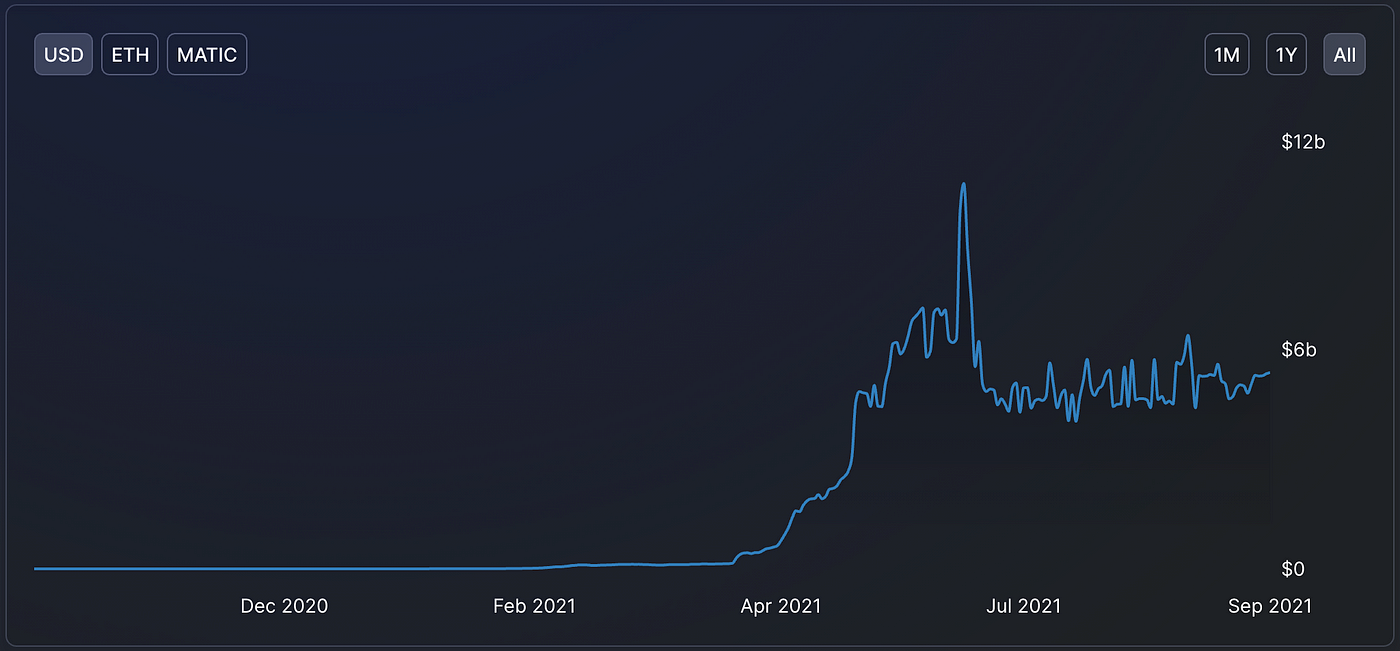

Polygon (Matic) was one of the first chains this year to launch an incentivization program to scale the adoption of the network in early April. Following the program launch, the network saw a hockey stick rise in unique wallets, volume, and TVL. Fantom, Celo, and Avalanche have borrowed a page from Polygon’s playbook.

Solana, on the other hand, has taken a different approach to increase adoption. Since Nov 2020, they have conducted several global and regional hackathons providing resources, funding, and marketing support to the winning projects. Their latest hackathon, Ignition, aims to be the biggest one yet.

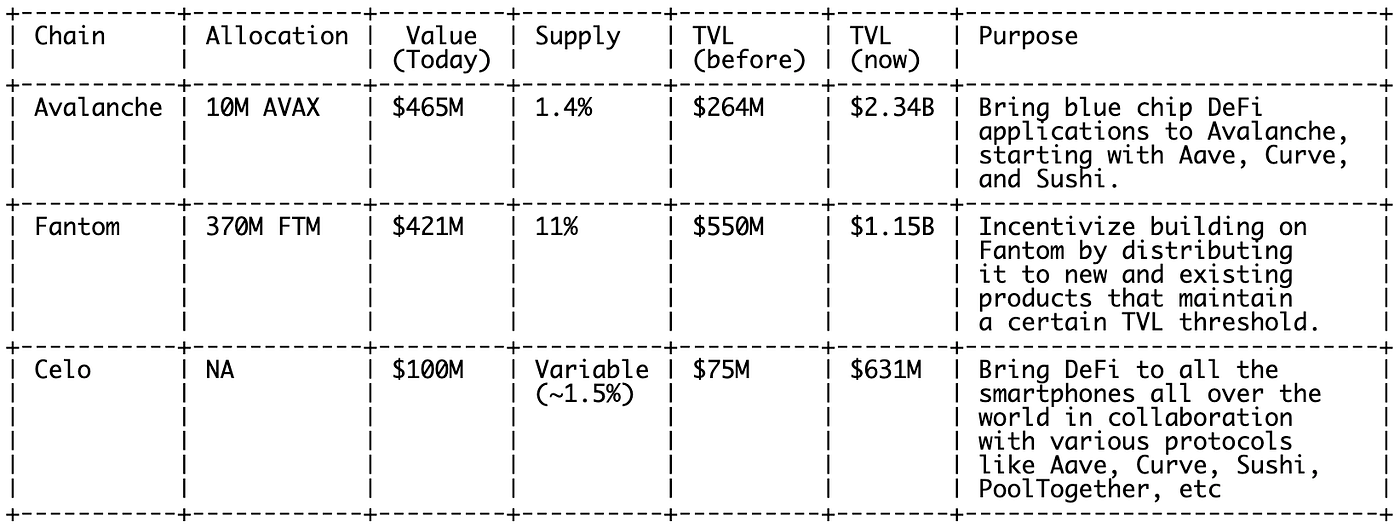

Let’s take a deeper look at these incentive programs:

Although all these programs seem alike at first, we can spot the difference when looking at their purpose and the percentage of supply allocated. Avalanche and Celo are quite similar with putting ~1.5% of the supply as incentives and aim to bring DeFi applications to their platform. Fantom is quite different as it is allocating a bigger percentage and also its focus is not just DeFi.

As we can see, there has been a massive increase in the TVL (Total Value Locked) for all these chains after the announcement of the incentives. However, the below challenges with UX may deter the adoption within the crypto ecosystem:

- Bridges are complex to use, and most often, the resources are not readily available.

- Not all tokens are accessible across chains.

- Grasping the alternate defi landscape is complex.

The above challenges might not matter for a degen/ape, as they are accustomed to digging for alpha. But, for a relatively new user, who has just become aware of the Ethereum ecosystem, these channels may lead to apeing in late or not apeing at all.

Other sleeping blockchains like Polkadot, Harmony, Zilliqa, and Cardano are likely in the final stages of their PMF and may soon launch their own Incentivisation programs.

Now, I have two questions:

1. Do incentivization programs work?

2. In the long term, will the other L1s sustain?

First, the incentivization programs — for this, I will take two examples.

Let’s consider Polygon. After the incentivization initiation, the network saw a parabolic rise in TVL, but it has struggled to back up since May’s market drop.

Blockstacks is another example. The network introduced App Mining Program to incentivize founders/devs to build products on the STX network. The pilot, launched in Dec 2018, saw initial traction and generated over 150 applications with a total payout of $800,000 (~20K$ per month) for selected apps.

The second phase of the program was when things went south. With 30M STX left in the allocation table, the program was abruptly paused. The team cited reasons pertaining to revamping the program’s structure and solving challenges, including fair distribution of funds, privacy preservation, and decentralization. However, Crypto Twitter and intimate circles claim misuse of funds by devs. Most apps were not focused on decentralization (password managers, productivity tools, content creation platforms, etc.) and were unstable and unusable. The team is currently accepting proposals to deploy the 30M STX tokens.

The key takeaway being that incentivization programs do attract users and developers, but according to me, what should really matter is the quality of the product or the uniqueness. What do you think?

Coming to my second question — will users and devs move away from ETH? While I do not have a concrete answer, I decided to run a poll on Twitter on what devs think.

With these massive incentivization programs, as a dev/founder, which chain(apart from ETH) would you build your dapp/product (non-vanilla fork) on?

— Mohak Agarwal 🦁 Hiring (@mohakagr) September 3, 2021

The results? Mixed.

Radically, we knew that the multichain world was inevitable, but we did not anticipate that it would come so hard. In light of the change in the market, one thing is certain; we have to find interoperability solutions much faster than we had anticipated.

Meanwhile, I would recommend everyone to explore the ecosystems and holistically look at defi because innovations do not happen in a sandbox. That’s a wrap for this week’s Magnify.

Come hang out with me on Twitter @mohakagr.