Welcome, traveler! I know your journey through DeFi has been an adventure. We have explored some interesting protocols, understood how they generate yields, and established that they don’t serve our objective of getting sustainable yields irrespective of market conditions.

DeFi is still an emerging ecosystem, and several projects are emerging in different categories daily with different objectives.

Think about it…if there’s a protocol that auto-compounds the yield that you get on your existing yield-bearing tokens, then would it not be such a time-saver? You would not have to look for ways to extract maximal yield from your existing portfolio because there are already protocols.

But are the yields that they provide sustainable? Can these yields ride through a bear market? Let’s find out.

Generating yields from Yield Aggregators

Give us your tokens, and let us do the magic of compounding your net yield!

A yield aggregator - in essence - aggregates users’ funds into a pool and then uses the funds from that pool to divert them to various DeFi products like lending/borrowing protocols and/or AMMs to generate yield. Naturally, as these protocols are highly active in the market, they keep changing your positions dynamically to ensure maximum yield is extracted on your capital. And to achieve this, they follow a simple process.

Step 1: Aggregation

The protocol collects users’ funds and aggregates all of them into a pool. These funds are then used to mint stablecoins as collateral (on protocol like Maker).

Step 2: Utilization

The yield aggregator can then use the funds to divert them to different protocols such as lending protocols, AMMs, and/or other emerging DeFi protocols, where they get derivative tokens and governance tokens in return. The aggregator could even use pooled funds as collateral to borrow loans and then use the borrowed amount to borrow another loan to create a yield spiral.

The process looks dead simple. You deposit your capital; the protocol reinvests it to compound it. However, there’s more to it than what meets the eye. Think about the protocols that the yield aggregator interacts with - these are the same lending/borrowing, fixed-income, and AMMs that we have already discussed in the previous blogs. And these are the same protocols that have inherent IL (Impermanent Loss) and unsustainability risks. The core strategy that a yield aggregator employs to compound yields for its users may vary according to the protocol.

For instance, in the case of Yearn Finance - users’ funds are aggregated into pools known as vaults (known as yVaults), and they employ different strategies for generating returns. This could include using users’ funds to mint stablecoins and generate yield and using the yield-bearing tokens to re-invest into minting more stablecoins to compound the yield. Users also have the option to create their own strategy, which goes through a Strategy Vetting Process before it gets approved. The top five assets with the most TVL on Yearn Finance currently earn anywhere between 0.01% to 5.31% APY. How does that happen? Let’s examine the strategies of USDC, which is currently paying out an APY of 1.95%.

Generating returns through Yearn’s vaults

It employs a combination of different strategies, including supplying liquidity on Curve pools, supplying/borrowing USDC on Compound to earn COMP tokens, and a couple more, including Notional Finance, Tokemak, Balancer, and Angle Protocol.

- For Curve, we have already seen in the previous blog that while this is highly stable and there is minimal risk of IL, the returns are too low. Even for lending on Compound, we have seen that the returns are minimal and most of the subsidies come from the governance tokens themselves.

- On Tokemak, you get 4% APY for depositing USDC. Upon doing so, users get the value-accruing TOKE in return, whose value appreciation depends on how the liquidity of the protocol is directed across various DEXes in DeFi. As you can imagine, this opens the yields to further IL risks.

- On Angle Playground, you get 2% APY, which can be boosted by staking the LP sanToken that you get in return. Angle is a decentralized stablecoin protocol where users can deposit their assets to mint stablecoins. Undercollateralization risks exist here too (just like with MakerDAO), as your native assets are exposed to market volatility when you mint stablecoins (known as agTokens).

Being one of the biggest yield aggregators in the market, Yearn is a go-to for most users with the plethora of strategies it offers. But, as we have seen, they do not provide sustainability to the user.

Rari Capital, on the other hand, relies on a combination of the users' liquidity-providing and yield farming strategies. It lets users create custom lending/borrowing pools; however, you need a prerequisite technical expertise to understand what parameters to set for these pools. Harvest Finance relies on the LP tokens that users get from supplying liquidity on AMMs and using them to compound yield across various yield farming positions.

All yield aggregators rely on the base-layer DeFi protocols such as lending/borrowing pools and AMMs to generate yields for their users. The added benefit they provide to users is the active involvement in the market - which means users don’t have to dynamically configure their positions to extract the maximum yields from the market. However, some things remain the same:

- Your assets are exposed to the market volatility and IL risks as they would be if you were depositing them in these pools yourself.

- Other risks include unstable APYs, which can fluctuate according to the demand/supply of the assets.

- Moreover, as some of these aggregators rely on borrowing a loan and then re-investing it, liquidation risks in unstable markets also persist.

Their ability to perform optimally in bear markets is also questionable. If the entire DeFi market is in a bearish turn, then there are chances that the protocols the yield aggregators are integrated with are offering lowered APYs. This affects the net profit that the aggregator generates for users during a bear market.

Generating yields from decentralized hedge funds

Risky but still worth it?

Decentralized hedge funds follow a similar strategy to yield aggregators when it comes to investing in DeFi to maximize the yield for their users. Some of these hedge funds leverage ETFs to maximize capital for their investors. There are two popular decentralized hedge funds that stand out: IndexCoop and StakeDAO.

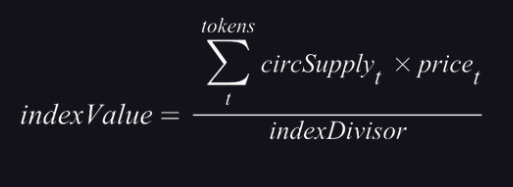

Index Coop has indices that track the performance of various DeFi products in the ecosystem. The famous DeFi Pulse Index (DPI) tracks the performance of various DeFi projects listed on DeFi Pulse and is weighted 40% Lending, 29% DEXes, 20% Derivatives, and 11% assets. In addition, they also have a Flexible Leverage Index (FLI) that lets users leverage a collateralized debt position by minimizing costs and the risks associated with maintaining collateralized debt.

However, leveraged ETFs suffer from volatility decay, which is the compounded yield loss over a longer time as the ETF's performance depends on its assets' daily volatility. IndexCoop attempts to offset the ETF's volatility by providing liquidity to the ETH2XFLI/ETH pool by relying on the trading fees that the protocol emits. Again, as we have already seen in the first blog, the underlying volatility risk of the assets coupled with the IL risks exist in this case too.

StakeDAO is another decentralized hedge fund that aims to extract maximal profits from the Curve-Convex system. When users deposit their LP tokens (that they get after providing liquidity on Curve) in StakeDAO, the protocol maximizes the profits by deploying them on Convex. This ensures that users get rewards in both CVX and CRV tokens. The profit to the users comes in when the harvested yield exceeds the performance fee (15%) that StakeDAO charges. They also provide governance subsidy in their native $SDT token (which can further be staked to earn rewards).

A key factor underlies these decentralized hedge funds - and that is the underlying volatility of the assets. In both cases, the protocols either rely on the market volatility of cryptoassets or that of the LP tokens. Again, since they abstract the complex process of consistently participating in the market and dynamically adjusting users’ position to extract maximum profits. This does not prevent your funds from being directly exposed to the volatility risks!

And we again find ourselves in a quagmire, don’t we? The more we explore DeFi and the various protocols within the ecosystem, the more we realize that it’s all the same. All composable DeFi protocols that rely on generating yields from lending/borrowing and/or AMMs are exposed to volatility risks. The yields that you get are seasonal but not sustainable.

What is sustainability anyway? What do we mean by making the yields sustainable? Sustainable yields refer to consistent yields that you make during ever-changing markets. Sustainable yields are the ones that never change despite the prevailing market conditions.

And you know how you can extract these sustainable yields?

The journey doesn’t stop here, adventures.

For the revelation is here…